IGR Maharashtra: Know About Registration And Stamp Duty Online @igrmaharashtra.gov.in

By Investoxpert | 02 Aug 2021 | Guide

IGR Maharashtra: Know About Registration And Stamp Duty Online, IGR Maharashtra refers to the office of the Inspector General of Registration and Controller of Stamps, which is responsible for registering documents.

If you buy a property in Maharashtra, then as a buyer you would need to register your sale deed at a government office after paying the stamp duty and registration charges. And, for your information this entire process is undertaken by the Inspector General of Registration and Controller of Stamps, also known as IGR Maharashtra.

Read Also: Godrej Buy 33 Acre of Land in Bannerghatta Road Bangalore

The stamp duty and other charges are a major source of government revenue and they are applicable on the registration of documents such as leave and license registration, mortgage, etc.

So, let’s Here is everything you need to know about IGR Maharashtra.

Read Also: DLF One Midtown

Read Also: Top 10 Best Luxury Apartments in Noida

What Is IGR Maharashtra?

The most advanced and digitalised department is the Registration and Stamps Office of Maharashtra state in the country.

See Also: Life Mission Kerala: Housing Scheme Eligibility, Beneficiaries And How To Apply?

Responsibilities of IGR

1. Helps in registering documents as per the Registration Act and collect revenue.

2. To deliver services effectively to the citizens

3. Works on modern technology, to register and collect documents using well defined procedures, within a specific time frame and in a transparent manner.

IGR Maharashtra: Property Valuation

For the registration process, the buyer should access the stamp duty amount through IGRS Maharashtra. For this, it is important to know the true market value of the property for sale.

Read also: Top 10 Best Luxury Apartments in Gurgaon

Read Also: Buy Residential and Commercial Property in Noida

Read Also: Loan Against Property In Noida

The dedicated department every year prepares an Annual Statement of Rates (ASR), also known as ready reckoner rates. This can be obtained from the sub-registrar’s office or online, using the following steps:

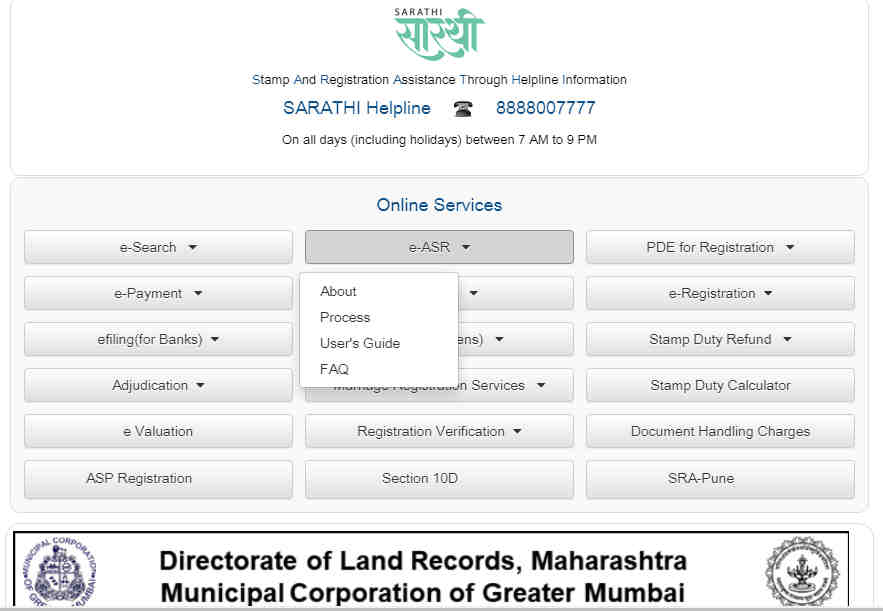

Step 1: Visit IGRS Maharashtra website http://igrmaharashtra.gov.in/frmHOME.aspx.

Step 2: Select the option e-ASR >> Process under ‘Online Services’.

Read Also: TVS Emerald Singasandra Bangalore

Read Also: Godrej Pimpri Chinchwad Pune

Read Also: ATS Homekraft Rohini Delhi

Read Also: Max Sector 128 Noida

Read Also: Godrej Woodsville

Read Also: Paras Floret

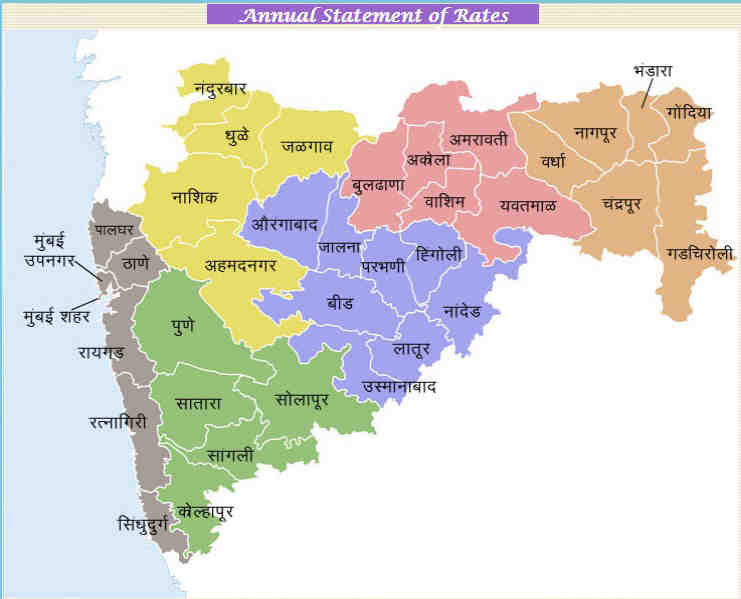

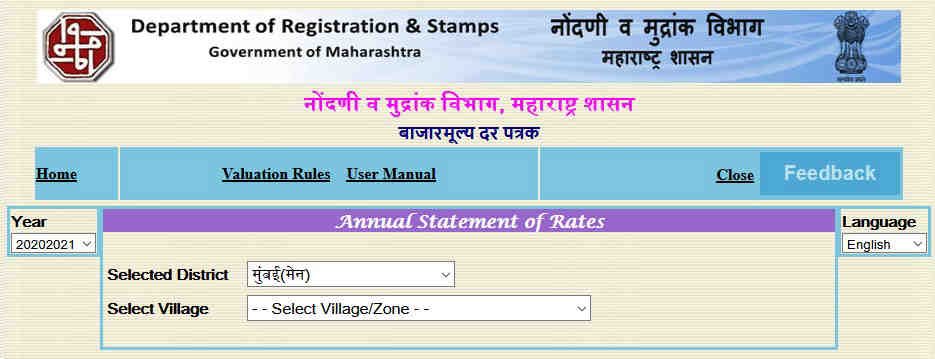

Step 3: You will be redirected to a new page where a map will be displayed. Click on the specific area where your property is located.

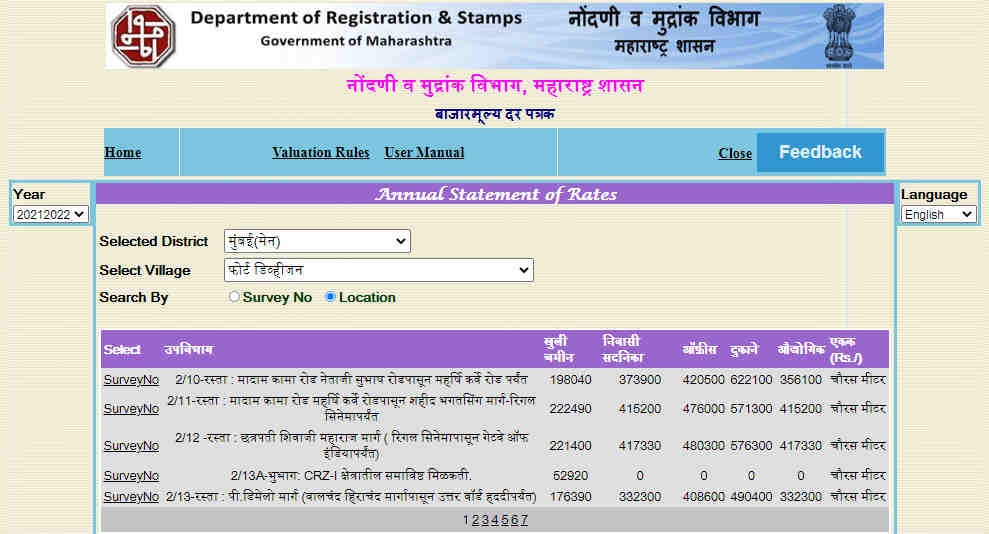

Step 4: You will be able to see the ready reckoner rates of the area.

Also Read: IGRS Karnataka: Use Of Kaveri Online Services And Karunadu Website

Read Also:- Top 10 Best Residential Projects in Gurgaon

Read Also:- Top 10 Best Residential Projects in Mumbai

What Are Ready Reckoner Rates?

Ready reckoner rates are referred to the government-decided price, below which any property in an area cannot be transferred in the government’s records. It is also known as guidance value, circle rate and keeps on changing time to time. These are pre-fixed rate that are different in different states. In Maharashtra, however, this rate is most commonly known as ready reckoner rate or RR rate.

Get Stamp Duty Refund Through IGR Maharashtra

In 1958, the Maharashtra Stamp Act allows refund of stamps purchased by citizens only if:

• The purpose of its use is cancelled.

• The stamp is damaged before its use.

• It is overpaid.

Apply for the refund by the application that has to be submitted to the stamp collector from where the stamps have been purchased. And, further proceed with the necessary documents within the prescribed time and format.

Read also: IGR Odisha : Inspector General of Registration Details

Documents Required For Stamp Duty Refund:

1. Online information filling token.

2. Document with original stamp.

3. Affidavit of the person, if the stamp is purchased by hand.

4. Authorised letter or certified copy of power of attorney, if an authorised person is applying for the refund.

If the stamps were purchased by franking:

Read Also: Smart World Sector 111 Gurgaon

Read Also: L and T Sector 150 Noida

Read Also: M3M Sector 111 Gurgaon

1. Invoice of the franchise stamp dealer, accruing stamp duty to the government.

2. Stamp sale certificate / excerpt of stamp sales register.

How To Calculate Stamp Duty on IGR Maharashtra?

The buyers of the property easily in few simple steps can calculate stamp duty on IGR Maharashtra portal:

Step 1: Visit IGR Maharashtra and click on the ‘Stamp Duty Calculator’ option under the ‘Online Services’ section.

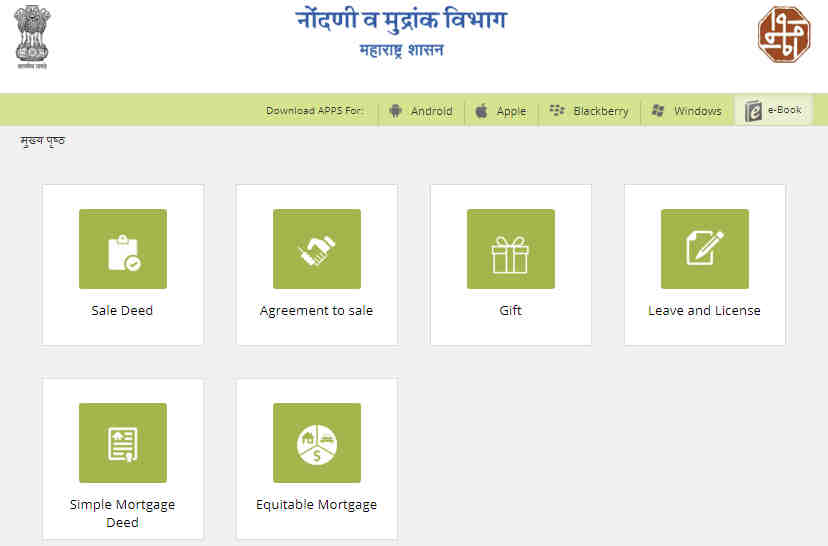

Step 2: You will be redirected to a new page where you can select the type of document which needs to be registered.

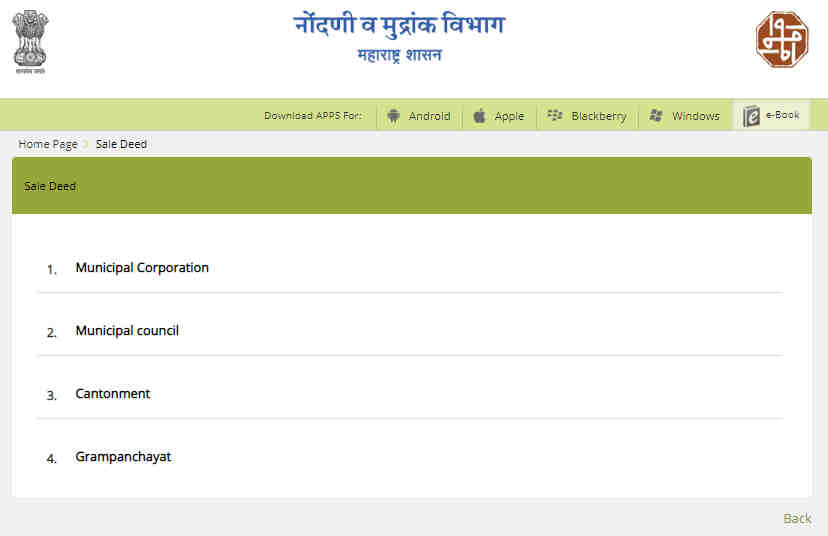

Step 3: Select the ‘Sale deed’ option to register your property papers and then select the jurisdiction from: Municipal Corporation, Municipal Council, Cantonment and Gram Panchayat.

Step 4: Enter the consideration value and market value to get the stamp duty amount displayed on the screen.

Also See: IGRS Madhya Pradesh: Registration Charges and Stamp Duty

IGR Maharashtra: Index 1, 2, 3 And 4

According to the types of documents being registered, the IGR Maharashtra prepares four types of indices:

Index 1 and Index 2 are prepared for immovable property.

Index 1 is prepared according to the initial of the parties’ names in the document.

Index 2 is prepared according to the village name in the document.

Index 3 is prepared for Wills.

Index 4 is prepared for movable property.

Read Also: M3M Sector 79 Gurgaon

Read Also: Smart World Sector 79 Gurgaon

Read Also: Birla Sector 150 Noida

Read Also: M3M Sector 128 Noida

IGR Maharashtra: How To Search Property Registration Documents

Users can easily search property registration details on IGR Maharashtra platform, by following the procedure given below:

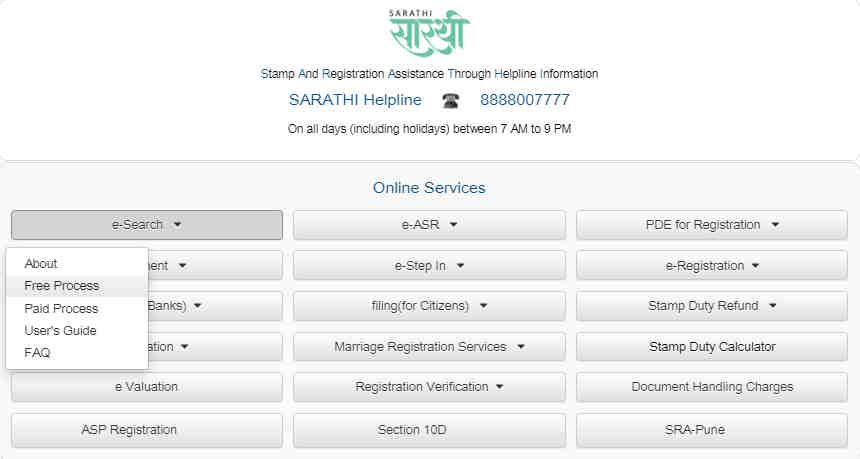

Step 1: Visit IGR Maharashtra and click on the ‘e-Search’ option and select ‘Free Process’.

Step 2: You will be redirected to a new page. Here, choose the location where the property is located and enter the required data, such as the property registration year, district, village, property number or survey number, etc.

Step 3: Click ‘Search’. The results will be displayed on the screen.

Also read: IGRS Uttarakhand: Know Everything About Stamp Duty and Registration Charges

IGR Maharashtra: What Is Index II?

The Index II extract is an official record of a document that is issued by the Registration Department. It also refers to transaction that is recorded in the records of the registering authority, confirming that the transaction has been completed.

Index II contains the following information:

1. Type of document: Sale Deed, Agreement for Sale, Gift Deed, Transfer, Mortgage Deed, Exchange of property etc.

2. Consideration amount of property.

3. Detail of the property, such as municipal jurisdiction, zone and sub-zone with landmark, property description such as CTS number, survey number, hissa number, gat number, floor number, etc.

4. Built-up area of the property in sq metres.

5. Nature of the property, such as land, residential unit (flat/room/bungalow), commercial unit (office / shop) and industrial unit.

6. Name of the parties: vendor(s) – vendee(s) / transferor(s) – transferee(s) / assignor(s) – assignee(s), etc.

7. Execution date.

8. Registration serial number.

9. Stamp duty amount.

10. Registration fee.

IGR Maharashtra: MoDT Registration

The home loan seekers will need to know that an undertaking, known as Memorandum of Deposit of Title Deed (MoDT), has to be given by the borrower. This states that they have deposited the title deed and other property-related documents with the lender.

Then, further the government levies 0.3% stamp duty on the loan amount. This undertaking is to recover debts, in case the borrower defaults or does not make payments on time. It is compulsory for the borrowers in Maharashtra to get the MoDT registered.

Read Also: IGRS Rajasthan And The Epanjiyan Website: Know About It

Read Also: - Top 10 Best Residential Projects in Pune

Read Also:- Top 10 Best Residential Projects in Kharadi

Read Also: - Top 10 Best Residential Projects In Undri

Read Also: - Top 10 Best Residential Projects in Wagholi

Read Also: - Top 10 Best Residential Projects In Bangalore

Read Also: - Top 15 Best Residential Projects In Gurgaon

Read Also: Top 10 Best Residential Projects In Noida Extension

Read Also: - Top 10 Best Residential Projects In Sector-150 Noida

Read Also:- Top 10 Best Residential Projects in Noida

Read Also:- Top 10 Best Residential Projects in Wakad

Read Also:- Top 10 Best Residential Projects in Bavdhan

Read Also:- Top 10 Best Residential Projects in Nibm

Read Also:- Top 10 Best Residential Projects in Talegaon

Read Also:- Top 10 Best Low Rise Apartments in Gurgaon

Read Also:- Top 10 Best Residential Projects in Mamurdi

Read also: Top 10 Best Commercial Property in Noida

Read Also: Top 10 Best Luxury Villas in Noida

Read Also: Top 5 Best Luxury Projects in Delhi

Read Also: Top 10 Best Luxury Projects in Bangalore

Read Also: Top 10 Best Luxury Projects in Gurgaon

Read Also: Top 10 Best Residential Projects In Chennai

Read Also: Top 10 Best Residential Projects in Dwarka Expressway Gurgaon

Read Also: TARC Kirti Nagar Delhi

Read Also: Top 10 Best Luxury Apartments in Pune

Read Also: Top 10 Best Luxury Apartments in Mumbai

Read Also: M3M Projects in Gurgaon

Read Also : Assetz Group Property Bangalore Real Estate Developer And Builder

Lets Get Your Dream Home

I authorize InvestoXpert and its representatives to Call, SMS, Email or WhatsApp me about its products and offers. This consent overrides any registration for DNC / NDNC.