What Is Malguzari System Know Its Relevance And How It Differs From Majkoor?

By Investoxpert | 02 Dec 2023 | Real Estate

An antiquated levy known as the malguzari tax was implemented in India during the British Colonial era. It involves obtaining from the farmers a fixed land tax. The system pays them a certain sum according to the size of the land. Nonetheless, this approach was criticized for being overly strict and for aggravating agricultural problems. Let's investigate this idea of the Malguzari System found in Indian land records in more detail.

Malguzari tax was a system of land revenue collection in which peasants made regular payments to their landowners. India's agrarian economy was molded by this colonial tax structure. It also serves as evidence of the realities of rural living and the taxes that were in place under the British Empire. The Malguzari income system and its significance in Indian land records are briefly reviewed in this article.

Read also:- What Is Patta Chitta And How To Apply For It Online?

Read also:- New Trends in Indian Real Estate – 2021

Read also:- What is BHK Full Form and Meaning in Real Estate !

Read also:- The Must-Know Facts Before Investing in Real Estate

What Is The Meaning of Malguzari?

Malguzari is the name of an ancient Indian land revenue settlement. Among all forms of exploitation, one method used by the East India Company to bolster its finances was the collecting of land taxes. A revenue farmer who would pay the land taxes was referred to as a "Malguzar." Let's continue reading to find out why the Malguzari method is important for India's land records.

What Is The Relevance Of Malguzari In India’s Land Records?

An important example of agrarian taxation in British India's past is the Malguzari system. Its significance endures because it illustrates the relationship between land revenue, colonial governance, and rural India's socioeconomic structure.

The legacy of the system highlights how land tenure has changed throughout time, providing insights into previous fiscal arrangements and their long-lasting effects on land use and management. The distinction between Majkoor and Malguzari is covered in the following portion of this blog.

Read also:- How Many Bigha in 1 Acre in in India - Up-Asaam Need To Know More

Read also:- Important Points For Buying Property Online

Read also:- What is this penthouse? You Need To Know More

Read also:- Leasehold Vs. Freehold- Definition And Difference

One Of The British Land Revenue System- Malguzari System

- The Malguzari system, in which the Malguzar was only a revenue farmer under the Marathas, was the type of land tenure that prevailed in the former Central Provinces.

- Upon assuming power in this area, the Marathas distributed the village income to wealthy and powerful individuals known as Malguzars.

- They were granted proprietary rights and required to pay taxes throughout the British Empire.

- A farmer would take over as headman of a village without hesitation if the headman was weak or incapable of providing the amount required by the authorities, or if the village was desired by a court favorite.

- Originally, the manager or farmer was known as Mukaddam (Hindi or Marathi for Arabic Mugaddam).

- The Lambardar/Sadar Lambardar, who was selected from among the Malguzars, served as the revenue engager in the Malguzari system.

The other cultivators were either lessees, sub-tenants, Raiyat-Malik, absolute occupancy tenants, or occupancy tenants, and they might be removed from their holdings for a variety of reasons. Malguzar, the proprietor or co-sharer, possessed land classified as Sir and Khudkasht land.

Understand The Difference Between Malguzari And Majkoor

Landlords would levy a charge known as the "malguzari tax," which was a set proportion of agricultural produce. Majkoor, on the other hand, refers to the present or a document displaying the current land records.

Read Also:- Top 10 Best Residential Projects in Nibm

Read Also:- Top 10 Best Residential Projects in Talegaon

Read Also:- Top 10 Best Low Rise Apartments in Gurgaon

Read Also:- Top 10 Best Residential Projects in Mamurdi

Understanding The Land Revenue System In India

One of the main ways that British people made money in British India was through the land revenue system. Three main categories of land revenue policies existed in India during the British era of rule. Prior to the country's independence, the three primary land tenure systems in operation were the Zamindari, Mahalwari, and Ryotwari systems.

Land Revenue System Under British Rule In India

The pattern of land ownership in India underwent a significant transformation with the establishment of British administration. Land ownership changed as a result of changes made to the land revenue collection system by the British. They implemented a strategy of land sales and eviction in the event that revenue was not received in full. As a result, zamindars grew rich and many peasants became landless, turning land into a transportable commodity.

The revenue rate was set at an unaffordable level, resulting in widespread suffering, mass evictions, and destitution. This was the main cause of the unequal land allocation.

The British introduced three types of land revenue policy in India, they are:

- Zamindari System (Permanent Settlement system)

- Ryotwari System

- Mahalwari System

Read also:- The Rise of Sustainable Living: Eco-Friendly Homes in India

Read also:- Interior Design Trends Transforming Indian Homes: Expert Insights

Read also:- ROI In Real Estate: Analysing Returns And Profits For Indian Investors

Read also:- Navigating Legalities: Essential Guidelines For Property Buyers In India

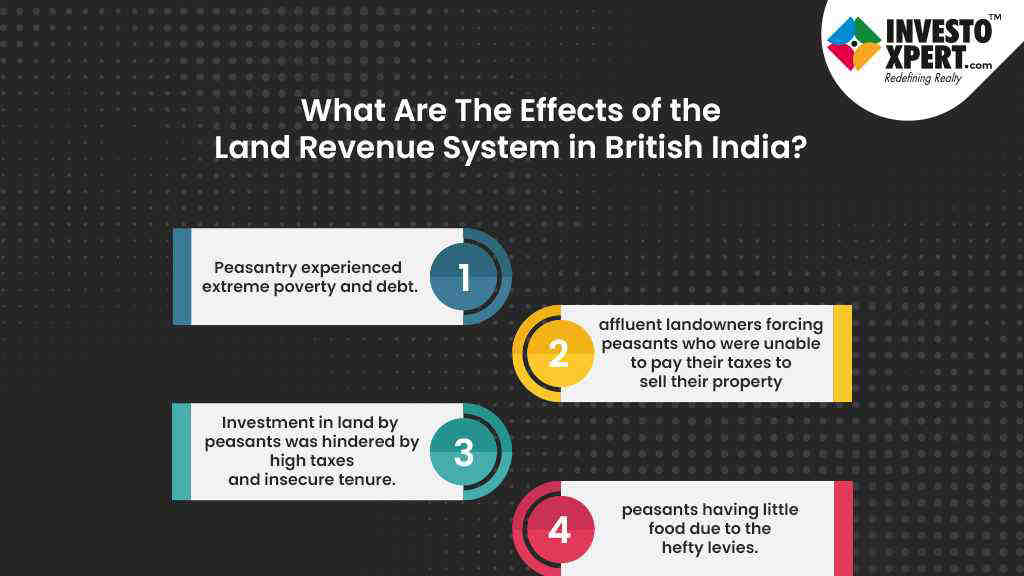

What Are The Effects of the Land revenue system in British India?

Among the many unfavourable effects of the British land taxation systems in India were the following:

- Peasants were frequently obliged to borrow money from moneylenders in order to pay excessive taxes. As a result, the peasantry experienced extreme poverty and debt.

- A concentration of land ownership in the hands of a select few was another effect of the land revenue systems. This occurred as a result of affluent landowners forcing peasants who were unable to pay their taxes to sell their property.

- Investment in agriculture was discouraged by the British land revenue regimes. Indian agriculture declined as a result of this. Investment in land by peasants was hindered by high taxes and insecure tenure.

- Famines in India were also a result of the British land revenue schemes. This resulted from the peasants having little food due to the hefty levies.

Conclusion

The Malguzari tax illustrates the complex interplay among land, income, and society. It mirrors the development of India's taxation systems while reshaping historical economies and landscapes.

Read also:- The Rise of Sustainable Living: Eco-Friendly Homes in India

Read also:- Interior Design Trends Transforming Indian Homes: Expert Insights

Read also:- ROI In Real Estate: Analysing Returns And Profits For Indian Investors

Read also:- Navigating Legalities: Essential Guidelines For Property Buyers In India

Read also:- Rental Market Trends in India: How to Make the Most of Your Investment?

Read also:- The Power of Virtual Reality in The Real Estate Business

Read also:- Mistakes to Avoid While Dealing in a Property

Read also:- Real Estate Trends That Will Rule in 2022

Read also:- RERA - All You Need To Know About Rera Gujarat Before Buying A House In 2023!

Read also:- Top 9 Amenities You Must Have In Apartments

Read also:- Why Invest In Lodha Bellagio Powai?

Read also:- Real Estate Regulations In India: RERA And Its Impact On Buyers And Developers

Read also:- Property Investment Guide For NRI’s To Invest In Indian Real Estate

Lets Get Your Dream Home

I authorize InvestoXpert and its representatives to Call, SMS, Email or WhatsApp me about its products and offers. This consent overrides any registration for DNC / NDNC.